Digitizes, analyzes, and scores transactions.

Artificial Intelligence for US Bank Check System

Digitizes, analyzes, and scores transactions.

Artificial Intelligence for US Bank Check System

An Advanced Fraud Detection Platform Leveraging Computer Vision, Machine Learning, and Artificial Intelligence for US Bank Check System

Our advanced fraud detection platform employs cutting-edge technologies such as Computer Vision (CV), Machine Learning (ML), and Artificial Intelligence (AI) to identify suspicious transactions in the US Bank check system.

By combining these powerful tools, we can effectively detect and prevent fraudulent activities, thereby ensuring the security of financial transactions and maintaining trust within the banking community.

visit site

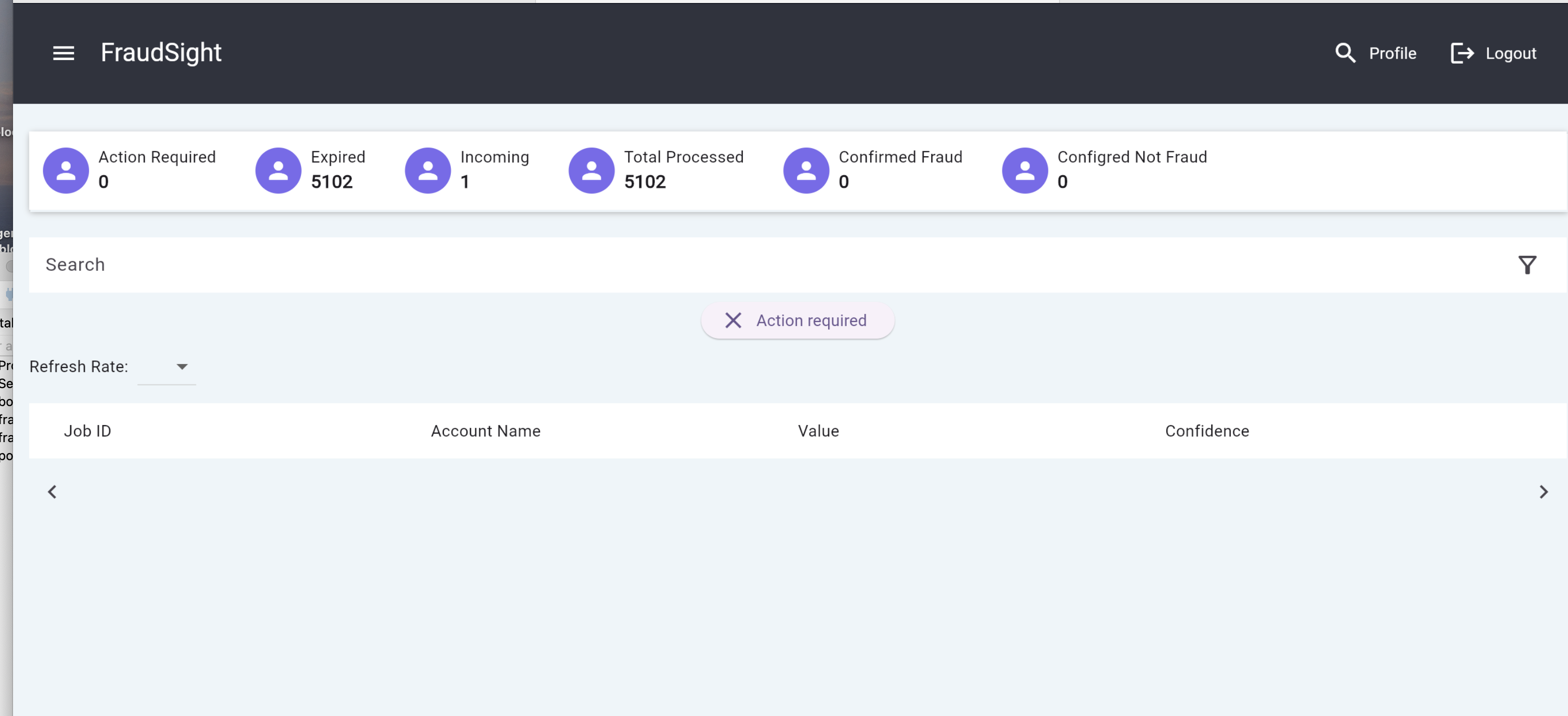

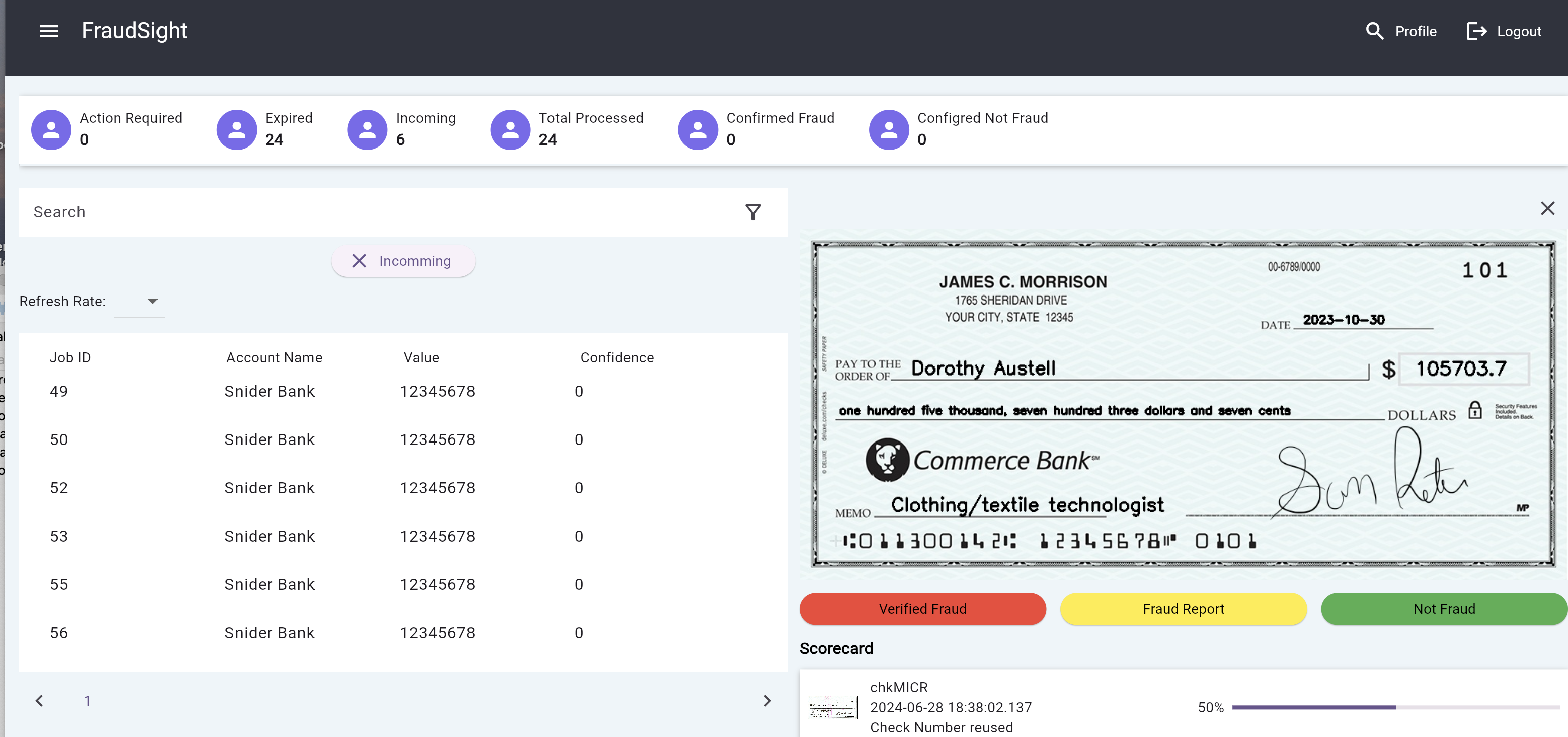

Dashboard

Fraud Event

Login

The platform is designed to analyze large volumes of check transactions processed daily by US banks. It begins with a pre-processing stage where checks are digitized using CV, allowing for precise image analysis. This initial step ensures that all relevant information, such as MICR lines and signatures, can be extracted and used for further analysis.

Next, ML models are applied to identify patterns in historical check data and learn normal behavior for specific account holders or geographic locations. These models continuously adapt and refine based on new data to improve detection accuracy over time. Suspicious transactions are flagged using a rule-based system and then subjected to additional analysis by the platform's AI component. This intelligent agent utilizes advanced reasoning capabilities to evaluate contextual information, such as check amount, frequency, and location, against established fraud patterns and historical data. The outcome of this analysis is a fraud risk score for each transaction, which is used to make real-time decisions on whether to block or allow the transaction to proceed.

By combining the strengths of CV, ML, and AI in our advanced fraud detection platform, we can:

- 1. Accurately identify and prevent various types of check fraud, such as counterfeit checks, altered images, and forged signatures.

- 2. Continuously adapt to new fraud schemes and evolving threat patterns.

- 3. Streamline the review process for legitimate transactions while effectively flagging potentially fraudulent ones for further investigation.

- 4. Enhance the overall security of US Bank check system by minimizing financial losses due to fraudulent activities.